Microsoft News

Optimise your logistics with Microsoft Power Apps

3 logistical areas Power Apps can help with

Working in logistics? Microsoft Power Apps gives you the power to design solutions that can optimise your processes from customer experience to delivery processes. Customers or employees can access Power Apps via mobile, tablets or desktop for remote access and to prevent data silos from forming.

Monpellier explores three areas Power Apps can be applied.

Create a Power Apps portal for customers

You can create portals using Power Apps for customers to connect with your business. They can set up an account with a delivery method, address, and payment options for a faster and seamless experience.

When processing the delivery requests, Power Apps can automatically generate tracking numbers, shipping labels, invoice documents and other necessary documents to save time.

Customers can check the progress of delivery within the portal through geolocation of the delivery vehicle and the number of drop-offs before arriving at the destination.

Create Power Apps for delivery drivers

Monpellier can create specific apps for different areas of your business. Everyone (with the correct permission) can access the data and see changes for faster and more effective communication.

Delivery drivers can utilise Power Apps features when scanning the barcode for pick-up or drop-off. Power Apps automatically recognises the barcode and updates the status of delivery on the database.

Power Apps can use a combination of geolocation tracking and AI to predict actual times when the delivery driver picks up the goods or drops them off.

Create Power Apps to manage parcel storage and security

Goods can be easily tracked using parcel numbers allowing for full traceability from the customer to the warehouse. Automatically assign a location code of the warehouse based on customer details and delivery service to the parcel number for better organisation.

Create individual employee accounts to monitor the actions such as transactions, location changes etc. This will improve accountability and allows employers to identify new training opportunities.

You can set up permissions to protect sensitive information such as customer and employee details. Management can specify who can access certain data and the ability to change the data.

If you want more information about Microsoft Power Apps and other products we provide, please follow the link here

Click here to get in touch with our consultants today and see how Power Apps can transform your business.

How Microsoft 365 has changed the modern office

Innovation, Integration and Collaboration

The creation of Microsoft’s productivity suite has completely transformed the modern office. Through Microsoft 365 cloud technology you can edit in real-time, access your work remotely and have the reassurance of Microsoft’s centralised security.

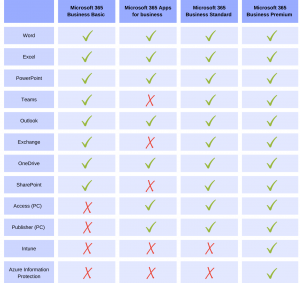

What is included in a Microsoft 365 Licence?

Top 5 features of Microsoft 365

1. Real-time editing

Cloud storage services such as OneDrive saves files online allowing remote access to files along with real-time editing with peers without the need of saving multiple copies or emailing back and forth.

Hot tip – Set permissions so documents can be securely shared with those with the right access.

2. Online Meetings

Microsoft Teams allows team members to meet, call and collaborate remotely.

Hot tip – Team members can create their teams, or chat with individuals with the ability to share and edit files from the local computer or OneDrive.

3. Mobile access

Mobile technology enables collaboration on the move. All files and apps are accessible as well as the capability to respond to different conversations and join meetings.

Hot tip – Schedule meetings within Outlook and add useful files for participants straight from SharePoint or OneDrive whilst on the move.

4. Intranet

SharePoint is a cloud-based service to create, store and share content online. Creating a company intranet that connects employees with different pages allows everyone to stay up to date with company news, job training, industry news and much more.

Hot tip – SharePoint has comprehensive search abilities that allow employees to find important information at the touch of a button.

5. Security

Microsoft 365 has unparalleled security giving the ability to meet key international, regional, and industry-specific standards and terms, with more than 1,000 security and privacy controls.

Hot tip – Create password policies that require users to reset their passwords after a specified number of days.

Future Development

- Microsoft Loop = Coming later this summer Microsoft Loop is designed to supercharge your project management. Find out more.

- Microsoft Mesh (for Teams) = A version of Mesh is already available but 2022 sees the release of the Teams integration update. Microsoft Mesh uses virtual reality for meetings enabling people to connect, work on 2d/3d content and feel connected with actual eye contact and facial expressions via holographic technology. To stay on top of Microsoft news, tips and Microsoft newsletter signup HERE to not miss out

Does your intranet solution feel outdated?

Enter a new age of integration with Microsoft Teams and SharePoint

2020 has been more than challenging for most businesses, and as a second national lockdown gets underway we certainly have more obstacles to overcome. According to Finder.com 60% of UK workers are now working from home, meaning that businesses have had to rapidly change their systems and processes to accommodate this new normal.

A common theme that has arisen is the need for fluid integration. Companies are leaning towards intuitive solutions that can cope with flexibility and work seamlessly with existing solutions. For this reason, SharePoint and Teams (working in unison) have provided companies with an affordable, powerful intranet replacement.

But can the pair really replace your historic intranet? We’ve collected some of our commonly asked questions to help you decide.

Should I use Microsoft Teams or SharePoint?

The answer here is simple, if you are using Teams you are already using SharePoint you just may not realise it. Microsoft Teams is built into Office 365. Each Team you create is classed as a ‘Group’. Groups can have collaboration tools including shared calendars, documents and mailboxes. When a Group is created, a SharePoint team site is automatically created. This use of SharePoint is limiting, SharePoint is an incredibly powerful tool which can be developed into much more.

A good way to understand the division between Teams and SharePoint is that Teams facilitates cooperation on a personal level and SharePoint facilitates cooperation on an organisational level.

Will SharePoint be able to match the functionality of my current intranet?

With over 100 million users worldwide SharePoint is certainly one of the most popular intranets and although popularity doesn’t always translate to the right option for your organisation it does highlight how universally loved the solution is. One of the benefits of SharePoint is that it gives your business a huge variety of options. Yes, you can use SharePoint out of the box, but it can be developed, and with Microsoft Power Automate (formally Microsoft Flow) automated workflows can effortlessly boost productivity within your organisation.

Furthermore, due to SharePoint’s adoption growth over the past 12 months, you can be assured that continuous work will be done by both Microsoft and third parties to develop and support the application.

Can SharePoint and Teams help improve communication?

Communication is certainly more seamless with SharePoint and Teams. The applications working together can engage users across the whole organisation, make it easier to collaborate on projects and documents, store information and run meetings.

SharePoint contains a company-wide calendar to help organise events, key dates and holidays as well as team news channels that your employees can opt-in to follow. These few things are but the tip of the iceberg in relation to functionality. No solution can promise improved communication but it is clear that SharePoint and Teams make the process easier than it has been before.

Free Consultation

Monpellier are a trusted Microsoft partner specialising in providing an end-to-end solution and support. If you would like more information regarding Microsoft Teams or SharePoint give our team a call on 0191 500 8150 or email info@monpellier.co.uk.

Dynamics NAV (Navision) versus Dynamics 365 Business Central

The evolution of the all-in-one ERP

Just like your business, software evolves over time. It adapts to our ever-changing needs and advances processes by delivering more ground-breaking functionality. In 2018 Microsoft released Dynamics 365 Business Central to the enterprise resource planning market to replace what was Dynamics NAV (formally known as Navision). But how does Dynamics 365 Business Central compare?

Dynamics 365 Business Central carries all the same features as its older relative (Dynamics NAV) but has the added benefits of a true cloud solution. Benefits such as access to your information from anywhere in the world, real-time updates and easy integration. The transition from Dynamics NAV to Dynamics 365 Business Central is so much more than a face-lift, Microsoft has successfully created a cost-effective all-in-one-solution that can seamlessly grow with your business.

Here are some of the main reasons our customers have made the switch to Dynamics 365 Business Central.

1. Familiarity

If you have previously used Dynamics NAV or currently use any of Microsoft’s other products (Office, Teams, OneDrive, SharePoint, etc) there is a sense of fellowship you feel when using Dynamics 365 Business Central. Your actions become instinctive, which makes product training a smooth and timely process.

2. Freedom

Thanks to cloud technology, Dynamics 365 Business Central can be accessed from anywhere and any device with an internet connection. This monumental change lets you and your team access data and reports on the go and ensures you always have the most up-to-date information at your fingertips.

3. Cost

Take away hardware, infrastructure, onsite maintenance, manual upgrades and storage and you are now looking at a solution that is more cost-effective for your business. With Dynamics 365 Business Central, you pay a monthly subscription for storage, hosting, and continuous access to your data.

4. Security

Dynamics 365 Business Central can be hosted on Microsoft Azure which is one of the most trusted global cloud providers in the world. Azure boasts over 70 compliance offerings and has first-class embedded security and privacy.

5. Future-proof

With Business Central you have one platform that allows you to access all the modules and tools you need. From your Outlook to PowerBI, all your company data is connected and readily available and comparable. Furthermore, with Microsoft’s new AL coding the limit to extensions and integration has been removed. This core change means that D365 Business Central users now have flexibility never experienced before in the world of ERPs. Your solution can be individually customised to suit your exacting needs and processes, saving you valuable time and expenditure.

D365 Business Central and Monpellier

Monpellier are experts in providing custom, integrated solutions and delivering first-class support across a wide range of areas. For further information regarding the Dynamics 365 Business Central and the licences available please give us a call on 01228 550 167 or email info@monpellier.co.uk for a free consultation and demo.

Microsoft Teams Announce Upcoming Functionality

Our favourite new features from the July update

Since March, businesses across the world have adapted and moulded their way of working to meet new challenges. Many of us have become a custom to remote working and Microsoft Teams has become a permanent fixture in our working lives, and with over 75 million daily users it’s no wonder Microsoft has dedicated time and resources to constantly improving functionality.

The latest change was announced this month (July) and brings with it a whole host of exciting changes that will be introduced over the coming months. Monpellier has pulled together our top 5 features to look out for.

1. Together Mode

The sight of our colleagues segmented into multiple boxes on our screen may have become the new normal but Microsoft has created ‘Together Mode’ to bring a more human experience to video conferencing. Together Mode uses AI segmentation technology to digitally place video feeds into the same shared background. The new feature can even make participants look towards the active speaker dynamically by mapping features. Once released Together Mode will initially be able to host up to 49 people at one time and will include a couple of possible backgrounds including a lecture theatre and coffee shop.

2. Dynamic Stage

The Dynamic layout will optimise and adapt the sizing of different video feeds to maximise screen space and create the most engaging set up for those on a video call. Furthermore, to avoid those difficult moments when people find themselves talking over each other Microsoft Teams have introduced the ‘raise hand’ feature which will create a yellow box around the person wanting to speak next. You can also now choose the chat bubbles feature to make chat appear over the video so you don’t have to keep the chat panel open.

3. Whiteboard

Whiteboard in Teams will soon be updated with exciting extras including faster load times, sticky notes, text, and drag and drop capabilities. This will make using Whiteboard in meetings much easier for those who don’t have access to a touchscreen or Surface Hub to participate. For more information regarding Whiteboard check out our Supercharge your Meetings blog – https://www.monpellier.co.uk/supercharge-your-meetings/

4. Transcript

Although transcription is already available within Microsoft Teams the new live caption update will be able to identify who is talking and attribute the speaker’s name. This feature makes note-keeping incredibly easy and gives you a concrete record that you are able to review after each meeting to double-check that you are happy with what has been recorded.

5. Slash Commands

Slash commands aren’t a brand new feature but they certainly help you navigate Microsoft Teams as efficiently as possible. You can use a slash command to set your status to “online” or “away”. Alternatively, you can make sure you’re not missing out on anything important with /WhatsNew.

Some of the best slash commands include:

/Files – Shows the most recent files shared with you on Teams.

/GoTo – Lets you jump straight to a channel

/Call – Initiates a call with someone else on Teams

/Help – Delivers assistance via T-bot

/Saved – Takes you to your saved messages

For more information regarding Microsoft Teams and other applications within Microsoft 365 give our team a call on 0191 500 8150 and make the most of your subscription.

Connect and Grow with D356 Business Central

What is Microsoft Dynamics 365 Business Central?

Specifically designed for small to medium-sized businesses, Microsoft Dynamics 365 Business Central is an all-in-one management solution with a very desirable price point (from £52.80 per user/ month). Similar to Microsoft’s previous offering, Nav, D365 Business Central is an easy to use cloud (or on-premise) solution that draws all your systems together.

Essentials Licence: What’s included?

Financial Management – D365 Business Central includes all the basic features you have come to expect from an ERP system including; general ledger functionality, audit trails, bank management, budgets, deferrals, bank reconciliation, fixed assets and currencies.

Business Central can also help manage inventory costs and operational and departmental budgets. The look and feel is similar to that of Office 365 and you can dive deep into your data by integrating applications such as Power BI.

Customer Relational Management – Although it doesn’t contain the complete D365 CRM, Business Central does contain core CRM features that can help your business organise sales efforts. The functionality to record, manage and segment contacts based on a number of criteria is seamless and works with the full Office 365 suite.

NB – if you are looking for a complete CRM solution with all the bells and whistles, Business Central can be easily integrated with Dynamics 365 for Sales.

Supply Chain Management – D365 Business Central really shines when it comes to organising operations. Supply Chain Management gives you the capability to manage orders, oversee inventory, process orders, manage transaction and receivables. Furthermore, no matter where inventory is located, levels can be tracked even if it’s in transit!

Human Resources – From managing detailed employee records to tracking/ group codes and logging absences D365 Business Central’s HR functionality has changed dramatically since the days of NAV. The application now gives a more holistic approach to HR and even allows you to manage employee expenses, which can be reimbursed easily using the same method used to pay a vendor.

Project Management – Business Central has all of your core project management features covered, including; scheduling resources, managing budgets, task monitoring, resource planning and availability. All of the functionality including time sheets can be accessed remotely meaning that your workforce can keep up-to-date on the move.

Microsoft Dynamics 365 Business Central has two licencing options, the first of which (Essentials) includes everything we have covered in this article while Premium includes all the above as well as Service Order Management and Manufacturing.

D365 Business Central and Monpellier

Monpellier are experts in providing custom, integrated solutions and delivering first-class support across a wide range of areas. For further information regarding the D365 Business Central and the licences available please give us a call on 01228 550 167 or email info@monpellier.co.uk for a free onsite consultation.

First published: In Cumbria Magazine’s March Issue.

5 top tips to keep employee engagement high

How to keep your team together while working remotely

Managing remote employees can be difficult, but with the addition of a global pandemic, this task has become a lot harder. Although many organisations have been geared up for remote working for a while, many businesses have been thrown into the transition leaving teams disjointed in these uncertain times.

Understandably having the right IT solution is essential to remote-working but having those tools is just the beginning. A large proportion of the population is now in lock-down within their homes with their family’s meaning that distractions are abnormally high. If you also consider that many have heightened emotions due to health and economic concerns, as an employer it’s now more important than ever to take a moment to be mindful and factor these aspects into expected productivity levels.

To help employers through this difficult time we have pulled together our top 5 tips for keeping engagement high amongst home-workers during the COVID-19 outbreak.

- Online meetings – Keep weekly meetings going and keep teams together by using video conferencing tools (such as Microsoft Teams). Studies have shown that seeing each other (even virtually) has a positive effect on our mental health, helping us to feel connected whilst we work apart. Even a 10 minute morning check-in is enough to add a touch of normality to proceedings and will encourage team members to get ready for the day and mentally switch to ‘work’ mode.

- Collaborate – Ensure your team has access to everything they need by using a shared cloud application such as Microsoft SharePoint. SharePoint gives you the ability to create team sites for each of your ongoing projects allowing remote team members to share files, data, news and resources.

- Kitchen moments – The kitchen is the social hub of any office where employees catch -up and grow closer and share their lives. As we all work remotely this vital part of the day is missing. Be sure to encourage ‘light’ chat using tools such as Microsoft Teams, you could even introduce lunchtime quizzes or other fun activities to keep spirits high and team members connected.

- Reflection – A positive aspect of this current situation is that we have time to reflect on existing processes, systems and business procedures. Encourage your team to take time to think big picture and envisage an ‘ideal’ solution to areas that need improvement.

- Office budget – To boost productivity your team needs the right tools and supplies. From sending out office stationery packs to investing in cloud applications or even splashing out on new monitors there are plenty of ways you can help improve home-working for your team.

While we navigate through these testing times technology can help with engagement, collaboration, productivity and most importantly keeping us connected.

If you would like more information on remote working or solutions that could help your business during this time please get in contact with our experts on 0191 500 8150 or drop us an email at info@monpellier.co.uk.

Integrated Solution for Manufacturers

Microsoft Dynamics 365 Business Central

One of the most talked about trends for the next decade is digital integration. As accessibility to digital manufacturing tools, such as cloud storage, artificial intelligence and IoT sensors grows the concept of a ‘smart factory’ is becoming a reality. Manufacturers of all types can benefit from digitally integrating their operations.

Integration has been on Microsoft’s radar for a long time and they now have a vast, robust selection of solutions that all work together in perfect harmony. One such solution, which is priced for the SME market, is Dynamics 365 Business Central.

This all-in-one solution includes modules for; Financials, Purchasing, Inventory, Operations, Warehousing and Projects.

Let’s take a look at some of our favourite tools and functionality within Dynamics 365 Business Central…

Material Requirements Planning (MRP)

To avoid ending up in that all too familiar situation of having too much of one item and not enough of another the MRP functionality within Dynamics 365 Business Central focuses on making tracking bills of materials (BOMs) flawless. It automatically generates order suggestions based on demand and sales, giving you accurate order suggestions at a glance.

Scheduling

Our manufacturing clients often find the scheduling process the most stressful part of their business. Incorrect data or the slightest supply error and your whole schedule could suffer. Dynamics 365 Business Central slims down and simplifies the scheduling process with automatic production orders and purchase orders, action messages linked to balancing of supply and the option to set-up some items with individual reordering policies.

Capacity Measurement

Many businesses have the goal to grow in 2020 but with growth comes increased capacity. Dynamics 365 Business Central tracking capacity alongside materials and projects to ensure you never overbook or oversell – or lets you know you need to add to your facility, materials and team.

Inventory Items

Keeping track of raw materials, component parts and sub-assemblies can be exhausting. Dynamics 365 Business Central can quickly track these items and ensure you have what you need at all times. Keeping on top of your inventory like this can dramatically increase productivity and reduce time wastage during the production cycle.

Machine Centers

Machine centers are designed to help you manage the capacity of a single machine or resource. Within Dynamics 365 Business Central, Machine Centers lets you plan and manage capacity on multiple levels and had the capability to allow users to store more default information about manufacturing processes, such as setup time or default scrap percentage.

Dynamics 365 Business Central and Monpellier

Monpellier are experts in providing custom, integrated solutions and delivering first-class support across a wide range of areas. We lead with your business objective and take the time and care needed to plan, customise, implement, train and support the solution that will achieve your goals. Give us a call on 01228 550 167 or email info@monpellier.co.uk for a free onsite consultation.

First published: In Cumbria Magazine’s February Issue.

Microsoft Business Central – more than just Excel

Myth Busting D365 Business Central

Many accountants have relied solely or partially on Microsoft Excel to assist in their role for decades, leading many firms to ask when the next legacy solution will arrive.

Enter Microsoft Dynamics.

Over the past couple of years, Microsoft has shifted their focus to collaboration and have invested in new ways of working through Office 365. D365 Business Central is part of a wider product line of enterprise applications that all work together including applications focusing on sales, marketing, service, operations and CRM. D365 Business Central is the successor product for Microsoft NAV.

As D365 Business Central is still a relatively new offering in terms of ERP (enterprise resource planning) solutions Monpellier are here to clear up a few common misconceptions and equip you with the information you need to make an informed decision for your business.

Microsoft Myth Busting

Myth 1: ‘ERP solutions from Microsoft are far too expensive!’

A D365 Business Central licence is £52.80/user/month. A company with a financial director, controller, and management accountant would pay a little over £150/month for its ERP software.

Myth 2: ‘I will have to do a lot of work outside of D365 Business Central’

There’s a huge amount of connectivity with reporting tools like Power BI, which can be built directly into your ledgers. You can easily create bespoke reporting dashboards and have all of your valuable information at your fingertips.

Myth 3: ‘Extensive training to learn the new software will be needed’

D365 Business Central is a cloud ERP solution, meaning that delivery and installation is seamless giving users the ability to get up and going quickly. Furthermore, all applications are designed to work together and integrate with Office 365 creating a familiar layout for users.

Myth 4: ‘It won’t communicate with my emails’

If you get an email in Office 365 and use Business Central, there’s a direct interface that will recognise any email address affiliated with a customer or supplier. From there you can raise a sales quote or purchase order or invoice without having to leave your Outlook email inbox

Myth 5: ‘It’s just another accountancy package’

Like your Office 365 subscription, D365 Business Central runs on the Microsoft Common Data Service meaning that all your information is securely stored in the same place. This cloud-based storage option gives you the ability to supercharge your data by working seamlessly with Power Apps and Power Automate (previously known as Microsoft Flow).

D365 Business Central and Monpellier

Monpellier are experts in providing custom, integrated solutions and delivering first-class support across a wide range of areas. Grounded in technical expertise, the team is made up of professional financial accounting advisors and technology experts, who work together to advise, install and support the best business software on the market Give us a call on 01228 550 167 or email info@monpellier.co.uk for a free onsite consultation.

First published: In Cumbria Magazine’s January Issue, 2020.

Supercharge your supply chain

Business Intelligence Software

Food and drink companies are rapidly embracing new technology in order to optimise their processes and supply chain operations, and Microsoft is leading the pack in terms of supply chain reporting with applications such as Power BI.

Power BI is fully compatible with Microsoft’s other applications such as Office 365, Dynamics 365 and Business Central as well as being able to integrate with other supply chain systems you may have in place. The application is designed to create intelligent visualisations based on your business data to better support your decision-making processes. These engaging reports can easily be shared with one or more employees to create a business intelligence environment that can empower whole workforces. After all, knowledge is power!

Resolve your supply issues with Power BI:

Delivery information

Food and drink manufacturers often have multiple delivery vehicles but information such as delivery times, mileage, damage reports and down-time if often not recorded or lost entirely due to paper forms that are filled away. Power BI takes all this information crunches it and creates valuable reports that can improve delivery performance and overall operational efficiency.

Warehouse management

Manually tracking items available in the warehouse is not only time consuming but also open to all kinds of error. Microsoft Power BI provides a consolidated view of data collected from the warehouse, from multiple sources, and displays it in the form of interactive dashboards.

Remote working

Do you have multiple sites or employees that work in the field? The Power BI application can run remotely through a variety of internet-enabled platforms and devices. Desktop reports can be adjusted to fit into reduced screen sizes making them both user-friendly and succinct.

Connectivity

Sometimes it can feel like there is a device for everything, one to record stock, one to monitor machinery health, one to manage customer data, one for financials, it really can be an endless list. Power BI taps into the Microsoft Azure Cloud and other third-party data sources to bring all your data into one place. This gives your business the freedom to create new compelling datasets with a 360-degree view of your supply chain.

In conclusion, a business intelligence solution such as Power BI can unlock critical insights into your supply chain operations, therefore minimising the time associated with manual data analysis. Our Power BI customers see real change across their entire business as the added understanding the application brings leads to the more effective management of their operations and the ability to pinpoint and act on disruptions before they become issues.

Power BI and Monpellier

Monpellier are experts in providing custom, integrated solutions and delivering first-class support across a wide range of areas. Give us a call on 01228 550 167 or email info@monpellier.co.uk for a free onsite consultation and to start your business intelligence project today.

First published: In Cumbria Magazine’s December Issue, 2019.

How strong is your foundation?

IT infrastructure

A strong IT infrastructure is essential in supporting your business’s overall goals. You need to trust that no matter what is thrown your way that you have a strong foundation to keep your operations running smoothly.

But what falls under the term IT infrastructure? IT infrastructure consists of all elements that support the management and usability of data and is usually split into four categories, software, hardware, network and servers.

Since 2001 Monpellier have worked with SMEs in Cumbria and across the North East to help advise, implement and support elements of IT infrastructure. When it comes to building a strong foundation Microsoft Dynamics 365 has you more than covered. Dynamics 365 is a budget-friendly Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) solution that can adapt and grow with your business. Perfect for businesses that don’t want to fork out large amounts for their own hardware and onsite server, Dynamics 365 is neatly and securely hosted on the Microsoft Azure Cloud.

Dynamics 365 is a unified suite, making it a valuable base to your IT infrastructure. Unlike other full-suite software solutions, Dynamics 365 is modular so you only pay for what you need. This gives businesses options to scale up (or down) as their organisation changes.

Applications from Dynamics 365:

Finance – Monitor performance in real-time, predict future outcomes, and make data-driven decisions to drive growth.

Operations – Use predictive insights and intelligence across planning, production, stock, warehouse, and transportation.

Marketing – Increase customer demand for your products and services and improve marketing results.

Sales – Go beyond sales force automation to better understand customer needs, engage more effectively, and win more deals.

Field Service – Optimise your field operations with built-in intelligence, remote monitoring, and tools that enable your technicians to deliver quality work

Customer Service – Differentiate your brand, Built-in intelligence delivers faster, more personalised service and adds value to every interaction.

These six applications are just a snapshot of what Dynamics 365 has to offer with other applications such as HR, Talent and Retail also available.

From a user’s point of view, Dynamics 365 keeps all your systems unified and can ultimately reduce training and on-boarding, meaning a much shorter ‘learning curve’ for you and your team. Integration between systems becomes seamless and the size and complexity of your infrastructure stays firmly in your control.

Dynamics 365 by Monpellier

Monpellier are experts in providing custom, integrated solutions and delivering first-class support across a wide range of areas. Give us a call on 01228 550 167 or email info@monpellier.co.uk for a free onsite consultation.

First published: In Cumbria Magazine’s November Issue, 2019.

Supercharge your meetings

Microsoft Whiteboard App

Originally designed for the Microsoft Surface Pro the Whiteboard app became widely available earlier this year for web and within Microsoft Teams. You can now easily collaborate with people using Microsoft Whiteboard regardless of what device they’re using or if they have an app installed.

But what is the Microsoft Whiteboard App? Whiteboard is an interactive canvas jam-packed with intuitive features to help you visually communicate with others. It’s a fantastic tool for meetings and has the added ability to include remote team members, as it now works seamlessly with Microsoft Teams.

Our favourite features:

Save automatically – Your whiteboards are stored safely in the cloud until you’re ready to use them again. Gone are the days of taking pictures of whiteboards and flip charts following meetings, with the Whiteboard it’s all there ready without you even having to click save.

Share seamlessly – Microsoft has created several pre-designed templates for Whiteboard to help you mimic workplace scenarios such as brainstorms, project planning, sprint planning etc. More templates are being added each month so keep your eyes peeled for your new favourite.

Limit-free creation – Restrictions can block creativity. Whiteboard can transform your work into editable images, charts, flows, sticky notes and shapes on an interface designed for mouse, pen, touch or keyboard.

For more information on the Whiteboard and other applications within Office 365 give our team a call and make the most of your Office 365 subscription.

Is your team communicating effectively?

What is Microsoft SharePoint and how can it help me?

When it comes to communication within the workplace, technology continues to reshape the way we collaborate. But with an app for almost everything these days some businesses are suffering from communication fatigue. Make no mistake, technology is an amazing addition to any workplace but only when it’s the right solution.

With a market flooded with communication and collaboration tools, many businesses are resorting to sticking with outdated methods and processes.

Microsoft SharePoint has over 100 million users worldwide and is used by a whopping 78% of the Fortune 500.

What is Microsoft SharePoint

Developed by Microsoft, SharePoint launched in 2001 and is a web-based document management and collaboration tool. SharePoint works with Office 365 to create a server type environment designed for sharing.

If you choose to implement SharePoint into your business it is typically deployed onto your company’s network as a selection of intranet sites. Each site is designed specifically for each department with its own security, functionality and data.

Reasons to use SharePoint

Improve efficiency – The most common way businesses use SharePoint is as an intranet portal. SharePoint gives its users a powerful, fully-searchable centralised location from which to run operations. By dividing your SharePoint into separate team sites you can organise information and documents by department, ensuring data is but a click away. Unlike other intranet systems, SharePoint follows the same Office 365 style you are acclimatised to but adds additional intuitive features such as; highlighting upcoming deadlines and team scheduling data.

Cultivate positive collaboration – SharePoint is a content management system (CMS) and is used to store and share information. Its’ features include version management, business workflows and social aspects, which can all be accessed remotely. You can use SharePoint to accelerate productivity by transforming everything from a simple task to complex operational workflows.

Increase business intelligence – Your business collects so much valuable information, wouldn’t it be amazing to view all this data at a single glance and in one location? Through SharePoint’s integration capabilities, users can connect the platform with just about any existing information output from different applications. SharePoint is your one-stop-shop for custom-made business intelligence reporting.

Microsoft SharePoint by Monpellier

Monpellier (based in Cumbria and the North East) are experts in providing custom, integrated solutions, delivering first-class support and solutions across a wide range of areas from accounting & payroll to intranet and CRM solutions. Give us a call on 01228 550 167 or email info@monpellier.co.uk for a free onsite consultation.

First published: In Cumbria Magazine’s October’s 2019 issue.

Dynamics 365 Wave 2 Release

Our top 5 features

Microsoft Dynamics 365 is an application suite of ERP and CRM modules. This October saw the greatly anticipated Dynamics 365 Wave 2 release. The update gave users 400 new features and capabilities across Dynamics 365 and the Power Platform. This is one of Microsoft’s largest release waves to date and we wanted to highlight our favourite aspects that produce proactive insight and drive intelligent action.

Top 5 Updates

- Security – Dynamics 365 Fraud Protection is now available and provides a powerful solution that reduces fraud costs. To learn more about how Microsoft has used this technology to reduce fraud-related costs by millions of pounds in just two years visit – LINK

- User Interface – Business Central has seen the biggest change when it comes to user interface. New features including additional bookmarking capabilities, autofit columns, department overview functionality and the ability to work on multiple Business Central tabs at once are now fully available.

- AI Applications – Wave 2 sees the addition of two more AI applications, Product Insights and Connected Store. Product Insights transforms product development, marketing, sales and support by acting on real-time insight relating to customer usage while Connected Store uses data from cloud-connected sensors.

- Scan a Note – The new update allows you to take your meeting notes (as usual) with a pen and paper, you can then scan these notes straight into Dynamics 365. The sophisticated application then reads your handwriting turning it into an editable note that is stored against the potential customer. This allows you to keep all valuable information in one place insuring your sales team never misses an opportunity.

- Virtual Agent – Good customer service can take a lot of physical time but with the wave 2 release, your customer service team has a helping hand. Intelligent AI-powered robots have been designed with the ability to chat with customers, thereby improving speed and overall service.

Microsoft recorded their entire virtual launch event which you can watch by clicking the LINK.

Microsoft Dynamics 365 & Monpellier

If you’re interested in what Microsoft’s Dynamics 365 can do for your business, Monpellier can help. We are offering free, personalised onsite consultations designed to showcase the areas that would work for your individual business. Call our experts today on 0191 500 8150 or drop us an email info@monpellier.co.uk

Are you making the most of OneDrive?

Tips to boost your OneDrive experience

What is Microsoft OneDrive?

OneDrive is Microsoft’s storage service facility for hosting files in the cloud. Although you can sign up for OneDrive for free, you gain more as an Office 365 customer. OneDrive has been designed to provide a simple solution to store and share various types of documents and files.

How to make the most of OneDrive

Expiry Links

If you need to share a file with confidential data for a fixed period of time you can create a shareable link that is constrained by a set expiry date and time that you’ve pre-set.

Password Protected

Want to share very sensitive data? Microsoft has added password functionality so that the data you share has another layer of security.

Scan & Go

By using the OneDrive app you can scan, save and share documents that you can snap straight from your camera phone. It also lets you save these images as PDFs or directly into other applications such as OneNote.

Offline Mode

OneDrive gives you the option to make folders offline so that you can work on the go without an internet connection and back-up to the cloud once you’re back in the office.

Version Control

Whilst it’s important to make sure you are always working on the most up-to-date version of any document it’s also beneficial to refer back to older versions. OneDrive lets you look back at previous versions of each document to make sure no vital information is lost.

Outlook

We are all guilty of clogging up our inboxes with emails that on their own are useless but they have an attachment we want to keep. OneDrive lets you save these attachments straight to your chosen folder on OneDrive so that your Inbox stays clean and you don’t misplace important documents.

Microsoft Office 365 Apps & Monpellier

Are you interested in what Microsoft’s Office 365 Apps can do for your business? OneDrive is but a drop in the ocean when it comes to the capabilities provided by the Office 365 suite. If you are interested in finding out more and how they can integrate into your business give us a call today to arrange your free onsite consultation.

Farming for the future

How to start tapping into AI and the IoT

Imagine climbing out of bed before dawn but instead of pulling on your boots and heading into the cold you simply check your PC for any urgent updates on your livestock or crops? This vision is a reality for many working in agriculture thanks to the power of AI the IoT.

What’s the difference between AI and IoT?

Artificial Intelligence (AI) revolves around the simulation of intelligent behaviours in machines of all kinds. For example, a drone using a robotic lens examining the yellow flower of a tomato seedling to estimate the time it will take to become ripe, picked, packed and distributed. In comparison, the Internet of Things (IoT) is all about helping farmers reduce waste and enhance productivity by using connecting machines to gather data.

How can it be used?

Technology is constantly evolving and changing the agricultural industry in many ways from driverless tractors, drones, automated irrigation systems and crop health monitoring. Companies such as Microsoft have invested millions into partnerships and sustainable AI and IoT projects to help farmers maximise their profits. And they are not the only ones focusing on smart technology; many companies have developed solutions that work in harmony with Microsoft to combat the coming demand for increased production. The UN predicts the world’s population will reach 10 billion by 2050 which is a massive 2.5billion increase from 1970.

Here and now?

As useful as it is to read about the coming technological advances businesses in the North West can often feel forgotten and wondering how and what is available right now. The Azure solution from Microsoft gives you the perfect future-proof foundation to get started with AI and IoT. Azure is an ever-expanding set of cloud services with over 100 services and end-to-end tools that are designed to meet your exacting needs. Here are some examples of revolutionary solutions that work seamlessly with Microsoft.

SCR Dairy: Cow-monitoring system that gives farmers insight into milk production, the calving process and ensures healthier cows

GrassSat: Subscription service that gives online daily updates on grass cover and clear and actionable visualised maps and charts

Microsoft from Monpellier

Whether you’re ready to dive headfirst into AI or just need a knowledgeable partner to help you maximise your existing solution Monpellier can help. Based in Cumbria and the North East Monpellier provide support and solutions across a wide range of areas from accounting & payroll to CRM and EPOS. Give us a call on 01228 550 167 or email info@monpellier.co.uk to start farming for the future, today.

First published: In Cumbria Magazine’s August’s 2019 issue.

Join the Team – Most Loved Microsoft Teams Features

Number 3 in our Jargon Buster series: Microsoft Teams

Another tool within Office 365’s robust suite of services is the popular Microsoft Teams. Teams is a chat-based collaboration tool released by Microsoft in 2017. Although the tool is still somewhat ‘new’ to the market it has flattened the competitors and is now leading the space with the highest number of raw-user.

Microsoft Teams gives you and your team the space to collaborate, creating a shared work-space where you can chat, meet, share files and work with business apps.

The question is how does Teams help your business and which of its features would you find useful? We have pulled together our favourite features that our clients love for you to better understand if Teams is the right choice for your organisation.

Meetings

Microsoft Teams really shines when it comes to meeting functionality. Teams gives you the ability to host audio, video and web conferences with anyone inside your company or an external third party.

Features like scheduling assistance, note-taking, desktop sharing, uploading files, and chat messaging really highlights that Microsoft are focusing on making Teams the best-in-class tool for collaboration. Microsoft have announced Skype’s end-of-life date for July 2021 so for those that predominantly use this for their business conferencing needs it may be worth looking at making the switch to Teams.

In addition to its regular meeting features Microsoft Teams also has the capability to host live large meetings and events. For example, if you needed, with Teams’ help you could give a virtual presentation to up to 10,000 attendees!

Calls

The phone system within Microsoft Teams has PBX (Private Branch Exchange) capabilities and can even replace your on-premise PBX. Specialist calling features allows you to create call groups so that a specific colleague can answer your calls and gives you the ability to create and configure shared numbers.

First-line Benefits

First-line employees are often mobile, Microsoft Teams gives you access to training materials, handbooks, policies and on-demand video content via a mobile device. Compatibility with apps such as ‘Shifts’ creates seamless integration with your workforce management system.

Security & Compliance

Microsoft Teams was designed with your organisation’s advanced security needs in mind. Admin functionality grants you the ability to make granular changes and includes capabilities such as; data loss prevention, information barriers, retention policies, eDiscovery, legal hold, and more.

Free Consultation

If your business is ready to make the switch to Microsoft Teams, Monpellier are here to help. Monpellier are a trusted Microsoft partner specialising in providing an end-to-end solution and support. If you would like more information on Teams or any of Microsoft’s products, give our team a call on 0191 500 8150.

With over 100 million users worldwide, what is SharePoint?

Number 2 in our Jargon Buster Series: SharePoint

It’s hard to avoid a mention of SharePoint these days with many productivity experts hailing it as a must-have collaboration tool. But what exactly is SharePoint and how can it be used to help your business?

What is SharePoint?

In very simple terms SharePoint is a web-based document management and collaboration tool. It works with Office 365 and has a core set of functionalities including; document storage, intranet capabilities, and organisation sharing.

Benefits of using SharePoint

-

- Collaboration – Using SharePoint allows users to stay connected, even during live projects with the use of document version history. Losing information in a cluttered inbox becomes a thing of the past as all employees have access to critical and up-to-date documents at their fingertips.

- Security – Integrated security within the platform protects your data from unauthorised access. You can set permissions per user giving you ultimate control over user visibility.

- Customisation – SharePoint is jam-packed with unique tools that allow you to tweak your organisations build to look and function in a way that works for you. Add custom features, widgets, calendars and request forms to your organisation’s intranet in order to maximise productivity.

- Less Training – By working seamlessly with Office 365 SharePoint feels familiar from the start. In addition to support from your solution provider, Microsoft have free training courses available via their support site to help with the integration of your new collaboration tool.

- Informed Decisions – Use SharePoint to create personalised dashboards that allow your employees to see information from different sources and make better-informed decisions. For example, you could create a dashboard that acts as a live report area that allows you direct access to things such as KPI’s, critical financial data or even current stock levels.

Free Consultation

Monpellier are a trusted Microsoft partner specialising in providing an end-to-end solution and support. If you would like more information on SharePoint or any other Microsoft products give our team a call on 0191 500 8150.

What’s the difference between Microsoft 365 and Office 365?

As part of our Jargon Buster Series we’re looking into the world of 365

Microsoft is galloping ahead with their business software solutions and are constantly adding to their plethora of products and add-ons. But in this minefield of new offerings, it’s hard to make sense of what each product is, what functionality they include and how it can be applied to your business.

Our Jargon Buster Series has been created to cut through the noise, explain each solution in real terms and give you the information you need to make the right decision for your business.

Microsoft 365 VS Office 365

Microsoft 365 and Office 365 seemingly the same thing right? Unfortunately not…

Office 365 is Outlook plus the usual Office suite sold as a Cloud-based service through a subscription model. There are lots of different Office 365 plans (Business Essentials and Business Premium) that cover your different needs as a business. Subscriptions are calculated per number of users and have the benefit of always providing you with the most recent version making compatibility and upgrades a thing of the past.

In comparison, Microsoft 365 includes everything you get with Office 365 plus Windows 10, Enterprise Mobility + Security. This bundle gives you Microsoft’s latest operating system paired with a suite of mobility and security tools that gives your data extra protection.

So which option is right for me?

Realistically, the best option is to speak with a Microsoft Partner to ensure your chosen solution is the right fit for your needs. We recommend this because of the amount of options that can be added to your subscription is so vast a consultation with an expert ins simply invaluable.

However, in basic terms both solutions give you the full Office 365 package, but Microsoft 365 gives you even more (Windows 10 and Enterprise Mobility + Security). Apart from the additional features the only differences appear when it comes to device management. Unlike Office 365, Microsoft 365 comes with a single console to manage users and devices. This added feature lets you manage Windows 10 PC’s with an easy-to-use setup wizard.

Free consultation

Monpellier are a trusted Microsoft partner specialising in providing an end-to-end solution and support. If you would like more information on Microsoft 365, Office 365 or other Microsoft products give our team a call on 0191 500 8150.

Use Microsoft Power Platform to Enhance your Operations

Use Microsoft’s power platform to enhance your operations

The Microsoft power platform offers the opportunity to digitally transform your operations with a combination of:

- PowerApps

- Flow

- Power BI

These easy to use functions can improve the way you access and automate your data. In terms of your organisation, these functions will allow you to see where you’re at and how to implement them in order to enhance business operations.

To get the best leverage out of the Microsoft power platform, ask yourself the following questions. How can the Microsoft power platform:

Microsoft Power Platforms Improve Staff Effectiveness

Do you have users who require access to data from multiple systems in order to complete their daily workload? As your employees service your prospects and customers they will probably be accessing and updating data in multiple locations. This could include:

- Tracking sales in CRM software

- Marketing in marketing automation software

- Accounting in ERP software

- Customer service in ticketing software

Microsoft’s Power Platform, Flow, Power Apps and Power BI will enable you to improve staff effectiveness whatever data they require access to.

Automate Notifications and Transactions

Do you spend a lot of time on repetitive tasks, moving data between systems, sending notifications and transactions? Microsoft’s Flow can perform these tasks automatically for you and free up time so you can do other things. Notifications and transactions can be automated with the power of Flow.

Flow and Power BI also work well together. If one of your repetitive tasks is to alert people on particular data, then Flow and Power BI can do that for you.

Microsoft Power Platforms Enhance Decisions Oversight

Do you have business processes which lack oversight and approval? During different stages in a customer lifecycle, key decisions need to be made. This can occur where customer-facing employees don’t possess the know-how in making the right decision at the time in question. For instance, let’s say an employee is trying to close a sales deal. He or she might heavily discount one area to get the deal without understanding the impact of that discount to your business. With the Microsoft power platform, you can build review and approval into your business process. This will allow a manager to receive notification of a quote and approval or reject the quote before it actually gets to the customer.

Optimise Operational Reporting

Do you or your employees spend hours compiling data from multiple sources to obtain operational reporting? Do the reports differ from your colleagues in other departments due to different data sources? It can be very time consuming to compile operational reports. This time could be used to focus on other areas of your organisation like:-

- Business strategy

- Marketing strategies

- Customer feedback

With Microsoft’s Power BI you will be able to build a dashboard and transform your data to create visuals. These can be used to optimise operational reporting while combining data from multiple sources. If your data is in unrelated systems, you can leverage Flow and CDS to compile any relevant data automatically before reporting through Power BI.

So there we have it. Microsoft’s power platform can transform your operations to save you time while improving the effectiveness of your staff.